Disability Income Insurance

Introduction

Disability Income Insurance (DII) is a crucial financial product designed to provide individuals with a source of income in the event they become unable to work due to a disabling injury or illness. This type of insurance serves as a safety net, offering financial stability during times of crisis and helping policyholders maintain their quality of life. In this analysis, we will delve into the needs, benefits, and impact of Disability Income Insurance on families, lifestyles, and overall financial well-being.

Needs For Disability Income Insurance

Income Replacement: DII provides a portion of the policyholder’s pre-disability income on a regular basis. This replacement income can help cover essential expenses, such as housing, food, utilities, and other day-to-day needs.

Maintaining Lifestyle: DII helps policyholders maintain their current lifestyle, preventing the need to make drastic cutbacks or sell assets to make ends meet. This is especially important for individuals with dependents who rely on them financially.

Financial Security: DII offers peace of mind, knowing that even if a disability prevents the policyholder from working, there’s a reliable source of income to fall back on. This security can reduce stress and anxiety during challenging times.

Benefits of Disability Income Insurance

Income Replacement: DII provides a portion of the policyholder’s pre-disability income on a regular basis. This replacement income can help cover essential expenses, such as housing, food, utilities, and other day-to-day needs.

Maintaining Lifestyle: DII helps policyholders maintain their current lifestyle, preventing the need to make drastic cutbacks or sell assets to make ends meet. This is especially important for individuals with dependents who rely on them financially.

Financial Security: DII offers peace of mind, knowing that even if a disability prevents the policyholder from working, there’s a reliable source of income to fall back on. This security can reduce stress and anxiety during challenging time

Impact On Family And Lifestyle

Family Financial Stability: DII has a significant positive impact on families. It ensures that even if the insured person is unable to contribute financially, the family’s needs can still be met. This is particularly crucial when there are dependents, such as children or elderly family members.

Preventing Debt: Without DII, a disability could lead to accumulating debt due to ongoing expenses and medical bills. DII helps prevent this debt spiral, protecting the family’s financial future.

Education and Future Planning: Families can continue to save for education, retirement, and other future goals with the assurance of DII. The policy’s benefits can provide the necessary financial resources to stay on track with long-term plans.

Cost Impact

The cost of Disability Income Insurance varies based on factors such as age, health, occupation, income level, and the comprehensiveness of coverage. Generally, policies with higher income replacement percentages and shorter waiting periods before benefits kick in tend to have higher premiums. However, the cost of DII is relatively modest compared to the potential financial devastation a disability could cause.

Conclusion

Disability Income Insurance plays a crucial role in safeguarding individuals and their families from the financial turmoil that can arise from disabilities. By providing income replacement and easing the burden of medical expenses, DII ensures that people can focus on recovery and maintaining their quality of life. It offers a sense of security and stability during challenging times, making it an essential component of a comprehensive financial plan.

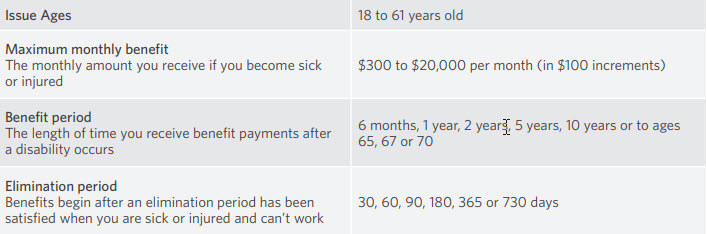

Income Solutions at a Glance