medicare supplement

Medicare Supplement Advantage

Medicare supplemental insurance, also known as Medigap, provides crucial advantages for individuals enrolled in Medicare. These supplementary plans help fill the coverage gaps left by traditional Medicare, such as copayments, deductibles, and coinsurance. By addressing these out-of-pocket costs, Medicare supplement insurance offers financial predictability and peace of mind, allowing beneficiaries to better manage their healthcare expenses. The flexibility to choose healthcare providers without network restrictions is another notable advantage, ensuring individuals have the freedom to access the medical services they need. Overall, Medicare supplemental insurance acts as a valuable complement to basic Medicare coverage, enhancing the comprehensiveness and affordability of healthcare for seniors.

You Can Get Help Paying For Health Care In Retirement

Many people choose to have Medicare and then take out a Medicare Supplement (or Medigap) insurance policy. You also have the option to opt out of Medicare and enroll in a Medicare Advantage plan. Each person — and situation — is unique, so it’s smart to talk with an agent to get the information you need as you move to the next stage of your life. We can help you better understand your rights, options and entitlements when it comes to Medicare, as well as discuss your Medicare Supplement insurance policy options.

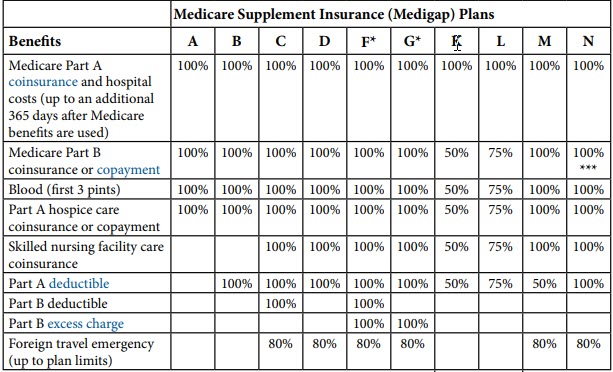

This chart shows basic information about the different benefits that Medigap plans cover. If a percentage appears, the Medigap plan covers that percentage of the benefit, and you must pay the rest. If a box is blank, the plan doesn’t cover that benefit.